Sustainability and Satellites: New frontiers in sovereign debt investing

WWF and Investec launched the ‘Sustainability and Satellites’ report at the Responsible Investor Europe conference in June 2019.

The report argues that advances in geo-spatial data and satellite imagery could help sovereign debt investors better assess and manage environmental risks — and may contribute to setting the global economy on a sustainable footing.

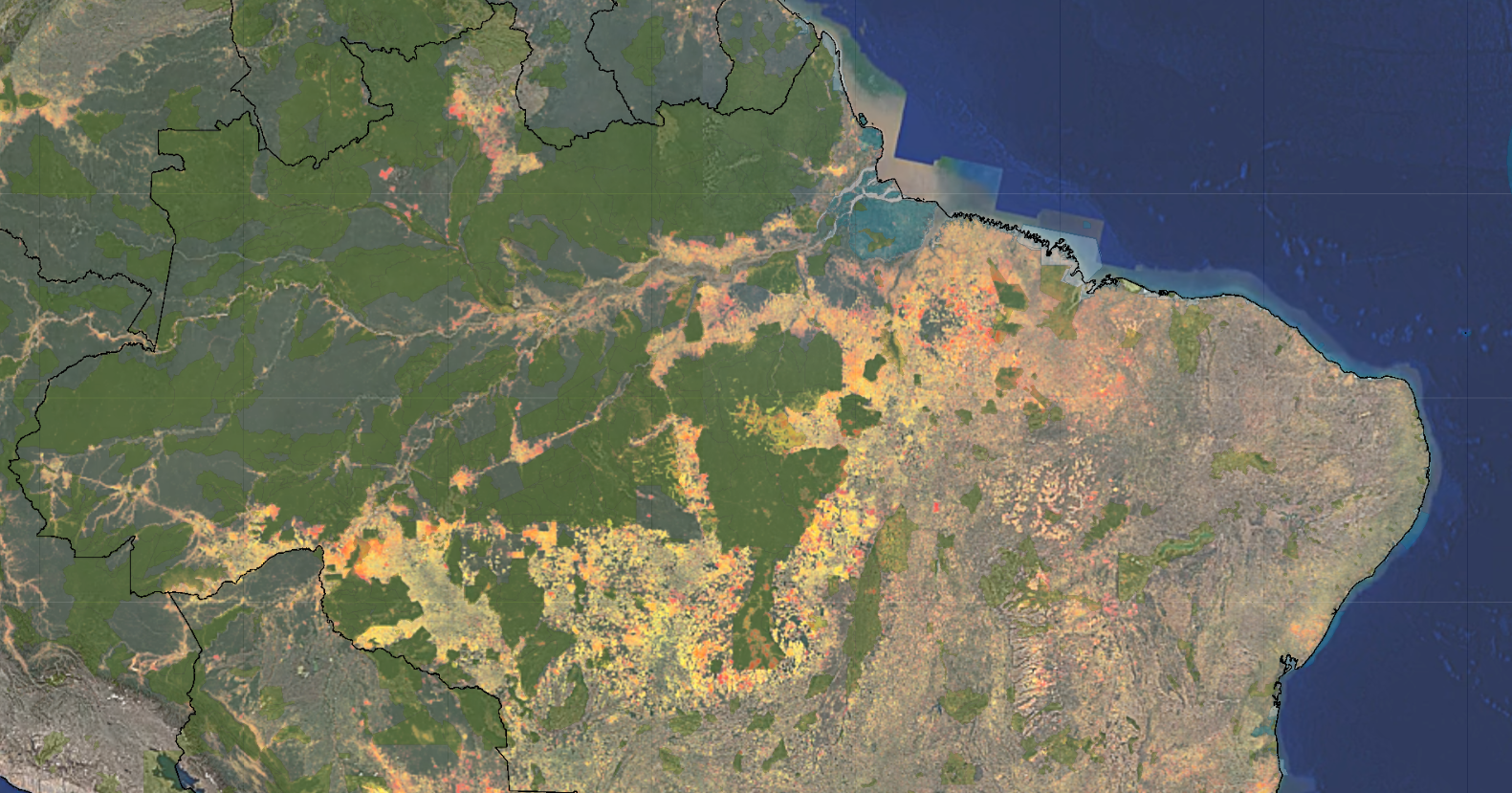

Figure 10 taken from the report indicates the forest loss in Brazil since the year 2000.

Figure 10 taken from the report indicates the forest loss in Brazil since the year 2000.

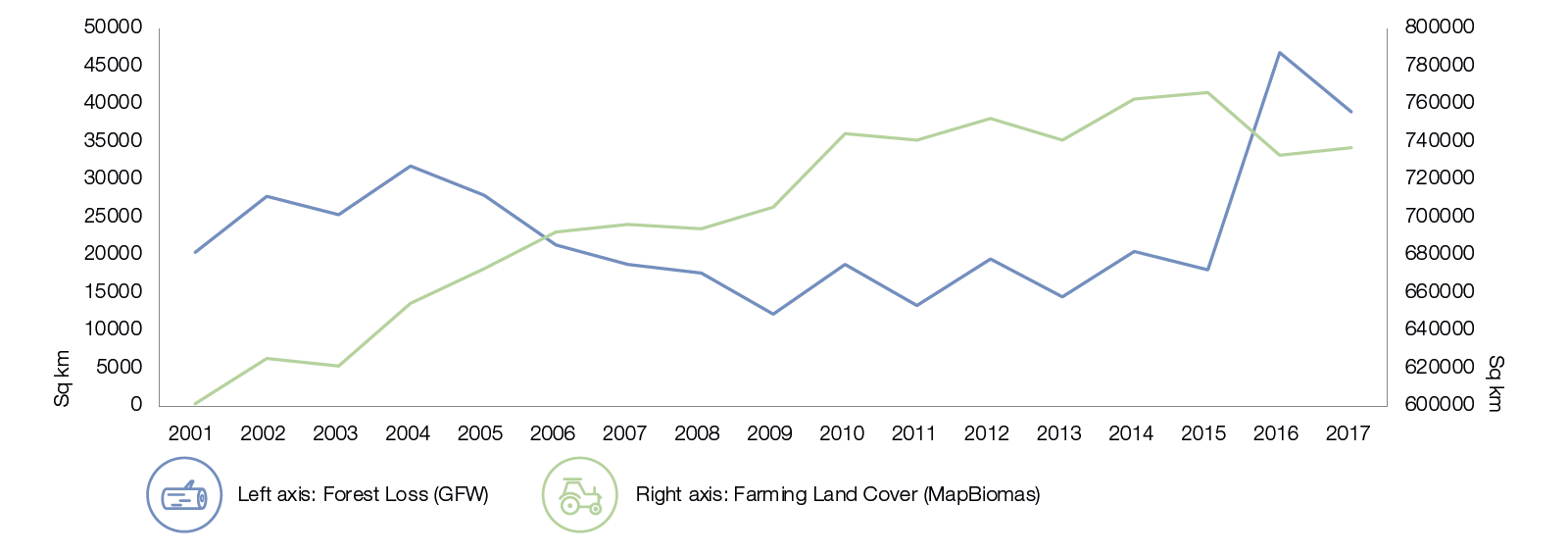

Figure 11 taken from the report plots the forest-loss data (2001 – 2017) from Global Forest Watch for the Brazilian Legal Amazon against farming and land cover data from MapBiomas. It reveals a tendency for the trend in farmland coverage tracked by MapBiomas to follow GFW estimates of forest loss, but with a lag of four years.

Figure 11 taken from the report plots the forest-loss data (2001 – 2017) from Global Forest Watch for the Brazilian Legal Amazon against farming and land cover data from MapBiomas. It reveals a tendency for the trend in farmland coverage tracked by MapBiomas to follow GFW estimates of forest loss, but with a lag of four years.

Investors in sovereign debt have an opportunity to help put the global economy on a sustainable path. The report explores how new research techniques relating to the application of spatial data in finance are transforming the ability of sovereign-debt portfolio managers to assess environmental risks.

Spatial finance is an emerging field that brings together geospatial data (essentially, any information with a geographic component), Earth observation (e.g., satellite imagery) and financial analysis.

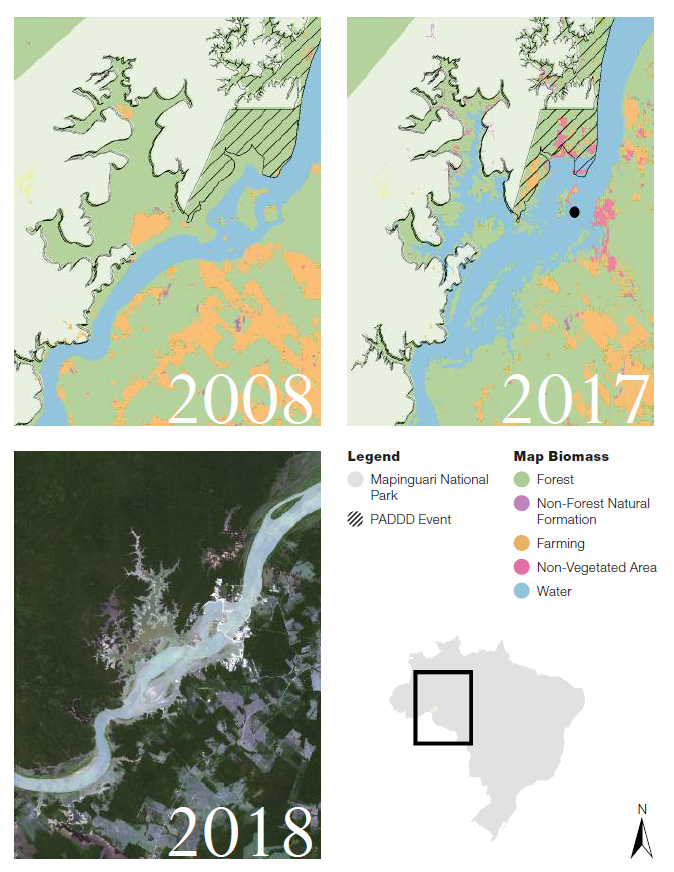

Brazil’s Mapinguari National Park experienced a PADDD event in 2008 to allow for construction of a hydro dam (black dot). The maps and satellite images show the subsequent flooding and the increase in farming and non-forested lands in the area where the PADDD event occurred (hatched).

Brazil’s Mapinguari National Park experienced a PADDD event in 2008 to allow for construction of a hydro dam (black dot). The maps and satellite images show the subsequent flooding and the increase in farming and non-forested lands in the area where the PADDD event occurred (hatched).

While more work is needed to interpret this data, the broad point is that ongoing monitoring of the spatial distribution of a nation’s extractive and infrastructure assets relative to its key social and environmental assets could provide valuable insights beyond those provided by traditional ESG metrics.

The report argues that the insights obtained from such techniques could be used not only to manage investor risk, but also to encourage sovereign issuers to adopt fiscal agendas that serve both people and the planet.

‘Sustainability and Satellites’ examines how spatial data – including satellite imaging – could enhance investors’ understanding of environmental risks at the country level. The report outlines that:

- The destruction of nature poses risks to national economies, and consequently countries’ ability to repay debt; therefore, sovereign bond investors need to address environmental risks in their portfolios;

- Analysis of geo-spatial data and satellite imagery will increasingly allow investors to obtain more accurate and timely assessments of environmental degradation;

- This will enhance investors’ ability to evaluate and monitor environmental risks, and facilitate their engagement with sovereign issuers in encouraging the adoption of fiscal agendas that deliver for people, investors and the planet