Climate and Nature Sovereign Index

The WWF-SIGHT team along with colleagues from WWF in collaboration with Ninety One (formerly Investec Asset Management) have developed a pilot Climate and Nature Sovereign Index (CNSI). It is an important first step to harness the power of sovereign debt investing to help safeguard the natural world.

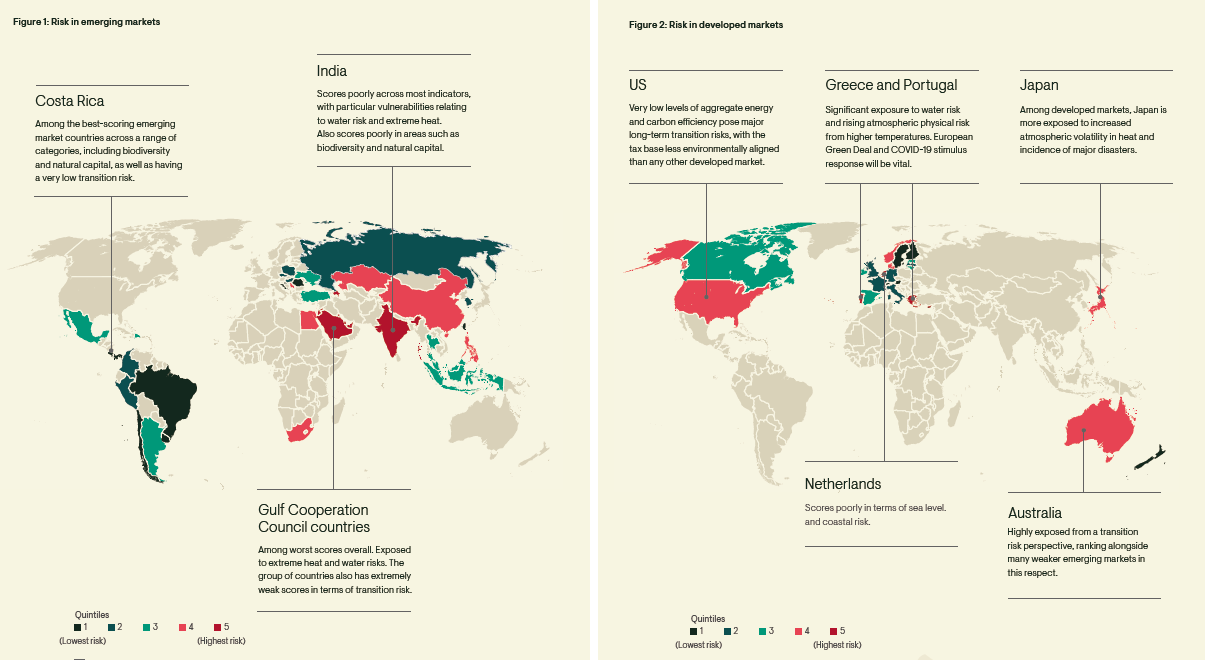

Figure 1; Taken from the CNSI publication, illustrating the CNSI results for emerging markets and developed markets. Source: Ninety One and WWF, July 2020. For illustrative purposes only.

This index is based on an innovative framework, which uses real-time and forward-looking indicators to assess long-term risks relating to climate change and nature loss at a country level. Such a framework should not only help achieve a more robust integration of environmental risk in the sovereign debt asset class, but also help countries in designing appropriate policy and institutional mechanisms that can make their borrowing more attractive and sustainable in the long term.

Employing the index in combination with new financing mechanisms would also help private and public sovereign debt investors to engage with countries in the post-COVID-19 recovery phase and help them transition to a sustainable trajectory that will make their investments more resilient to climate and nature-related and other risks alike.

Medium Blog – Harnessing sovereign debt investment in the fight for climate and nature.